VC investment in the UK reached record high globally in the first half of the year, with £11.8bn invested in the first half of 2021. Fintech and healthtech businesses remain the sectors attracting the largest funding with mega-rounds, and market participants expect significant investment in these fields throughout the year. Later-stage deals continued to attract the majority of investment, but interest in earlier-stage deals grew as more businesses began to raise Series A and smaller rounds. UK innovators attracted record levels of VC investment with >£6.5billion invested in UK scaleup businesses in Q2 2021 (KPMG). Deeptech investment continues to grow, with IQ Capital at the heart of this category and seeing exceptional opportunities to invest in IP-rich deeptech companies.

The first half of 2021 has been an exciting time at IQ Capital, growing and supporting our portfolio and developing our team. We’ve seen incredible deal flow from our network as we invest in transformative deeptech and thought-leading founders at Seed and Series A stages. In the last seven months, we have invested a record amount of £27m with round sizes totalling £75m. We have invested in seven new companies including Virti, CybSafe, Cambridge GaN Devices, Nyobolt. Managing Partner Kerry Baldwin was elected as the Chair of the British Private Equity and Venture Capital Association in April 2021, and Managing Partner Max Bautin was re-elected to serve as a member of the board of Invest Europe. We were also very proud to see two of our companies winning awards as Deeptech Investment of the Year and for Sustainable Innovation, and to be named finalists in the “Hottest VC Fund” category at The Europas Tech Startup Awards 2021.

To subscribe to our mailing list, click here.

FUNDING NEWS 🤩

Pangaea Data raised £3m further funding led by IQ Capital to accelerate deployment of its breakthrough AI with pharmaceutical companies and hospitals.

Divido raised £20m to transform retail finance and connects lenders, retailers and channel partners at the point of sale. The round was led by HSBC and ING. The company also received the Queen’s Award for Enterprise for its contribution to innovation.

CyberSmart raised £7m to protect SMEs against cybersecurity threats, led by IQ Capital, with Eos Venture Partners and Winton Ventures joining the round.

We have welcomed seven exciting new deeptech teams, including Virti, Nanosyrinx, Worldr, Foundries, CGD, Nyobolt and CybSafe. Virti raised £7.2m Series A funding led by IQ to improve human performance using interactive VR technology. Foundries.io raised £6.7m Series A funding led by IQ Capital. The company develops a platform that supports and ensure the security of connected devices while saving time and money. Cambridge GaN Devices raised £7m Series A led by IQ Capital. CGD delivers the most efficient and easy-to-use transistor based on Gallium Nitride (GaN) with a mission to enable a cleaner world by ingeniously designing electric components. Nyobolt raised £7m in a Series A round led by IQ Capital. The company develops energy-efficient ultra-high power batteries spanning a wide range of potential applications, including electric vehicles. CybSafe raised £5.6m Series A investment round led by IQ Capital. CybSafe has signed over 200 enterprise customers and aims to fundamentally transform the way that society addresses the human aspect of cyber security by pioneering the use of data and behavioural science to enhance the way organisations manage human cyber risk. Read more in Oz’s founder story below.

EXCEPTIONAL FOUNDERS COMMUNITY 💪

Our portfolio community engagement has reached an all-time high this year, with the introduction of new CFO and CMO communication channels to share best practices in finance and marketing, in addition to our regular CEO catch-ups. Together, we have reviewed the best SaaS metrics during valuations and exits, SPACs and IPOs in EU start-ups, and more recently the potential return to the office or the hybrid working model.

Get in touch in advance of your round!

Founder story: focus on Oz Alashe, MBE 📣

We’ve interviewed Oz Alashe MBE who shared his journey to founding and then scaling CybSafe, and his route to becoming an entrepreneur after serving in the UK special forces.

IQ Capital team update 🥳

Our team has grown by 70% in the last year, as we continue to deepen our connection with the UK’s deeptech ecosystems and strengthen the support we offer to the companies we invest in. Earlier in 2021 we were delighted to promote Jo Slota-Newson to Principal. Recent joiners include Pippa Pearce as General Counsel, with 12 years of experience in VC, and Elaine Hegarty as Operations Manager with experience in both Australia and the UK.

We believe that diverse minds make for the best decisions and outcomes. The teams we invest in comprise a diversified range of backgrounds and perspectives to optimise the outcomes of our investments. We participate in initiatives such as Level 20, Female Founders and the Investing in Women Code to encourage diversity among company teams, and actively promote and support the BVCA’s agenda and its initiatives. We actively mentor ethnic minority and female founders and outreach to new venture capitalists coming into the industry.

Kerry Baldwin, Managing Partner at IQ Capital, was elected as the Chair of the British Private Equity and Venture Capital Association in April 2021 – showing the importance of the UK’s early-stage tech and VC ecosystem. Earlier this year, she supported a number of Government policy priorities and contributed to the BVCA ‘Diversity & Inclusion survey 2021’ report. Kerry also judged a number of awards including the 2021 Europas Awards, Investor Allstars, TechNation AI.

Max Bautin, Managing Partner, has been re-elected to serve as a member of the board of Invest Europe. Max continues to engage widely in lecturing, judging various events and awards and mentoring portfolio companies on growth and M&A strategies.

Simon Hirtzel, General Partner and COO, is working on improving ESG reporting practices which are relevant to early-stage companies and wider industry stakeholders.

Ed Stacey, Managing Partner, added three further contributions to his regular series of articles in Forbes: “Will 2021 Be The Year That AI Finally Scales?“, “What Humans Can Learn From ‘Human In The Loop’ Learning” and “As AI Becomes More Ever Capable, Will It End Up Helping, Or Hindering, The Hackers?“

If you’re interested in joining one of the most active deeptech VC in Europe, we are currently recruiting deeptech analysts and investors to join our vibrant team.

We are recruiting – get in touch!

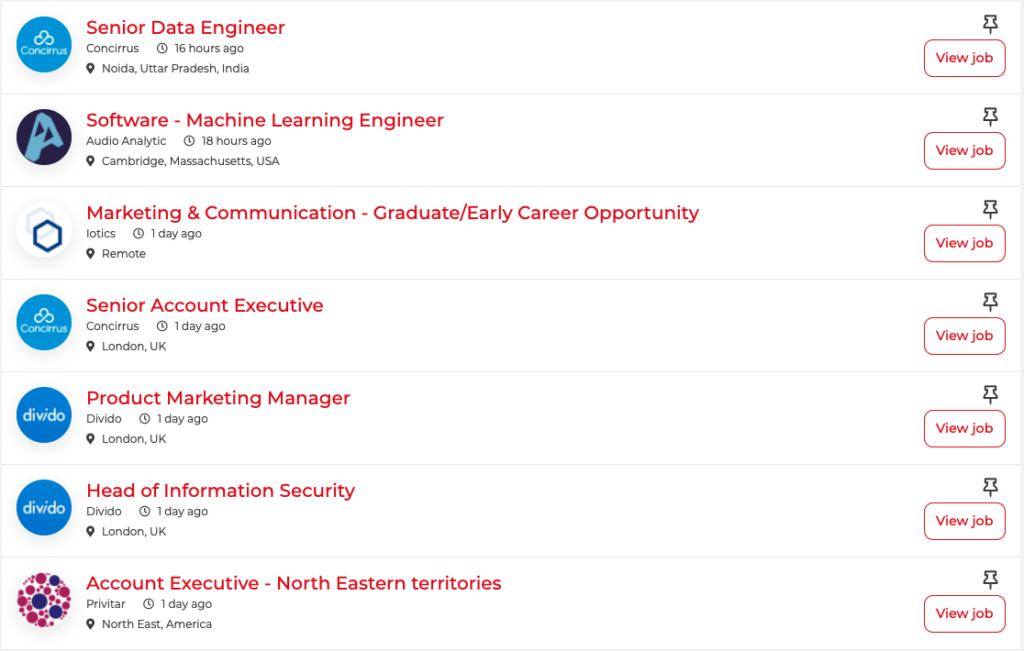

PORTFOLIO OPPORTUNITIES 👀

Our job board features more than 200 opportunities across our portfolio of 50+ companies. Have a look if you are currently seeking your next challenge!

As we look towards the future months, we will be adding more deeptech founders to both our Seed and Series A portfolios.

We hope you’ll have a good summer, and hoping to see more of you – hopefully in person – in the second half of 2021!

The IQ Capital Team

To subscribe to our mailing list, click here.