M∙QUBE – the new fintech mortgage lender using data and technology to deliver mortgages in minutes – has launched. It has secured £5m in seed funding to support its mission of transforming the UK mortgage market. In what was an oversubscribed round, M∙QUBE is now backed by some of Europe’s leading VC’s including AV8 ventures (lead investor), IQ Capital and JamJar Investments.

In addition to the £5m in operating capital recently secured, M∙QUBE will partner with a select number of high profile financial institutions, who will supply the debt capital used to issue mortgages. The business will work exclusively through mortgage brokers, using it’s partnerships with lenders, investment banks and asset managers to offer a broad range of highly competitive products.

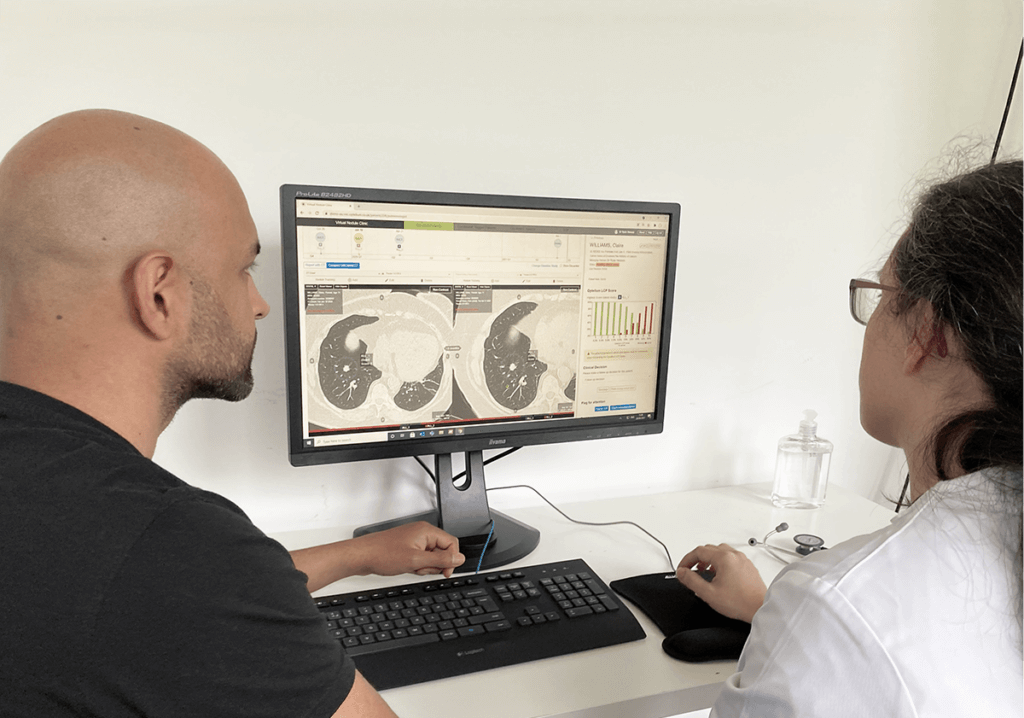

M∙QUBE has digitised and automated the entire process of applying for a mortgage, using data, deep learning and sophisticated technology. Documents supplied by a mortgage broker via the platform can be used to instantly retrieve thousands of data points relevant to an application. Typically M∙QUBE use 5-7 times more data than traditional lenders to analyse cases, supporting a robust, data rich underwriting decision in minutes, for both simple and complex cases.

By effectively analysing large data sets, M∙QUBE is able to provide applicants with tailored products, designed to cater for their specific needs. Where currently many cases are denied because lenders lack the operational capacity to review each borrower in detail, M∙QUBE’s platform has re-engineered the application process to support truly personalised lending decisions.

M∙QUBE’s technology also allows brokers to verify the accuracy of customer data before applications are submitted. This prevents many of the delays in the application process (currently averaging 15-20 working days) which often lead to property deals falling through.

As all M∙QUBEE offers are legally binding (as opposed to the commonly issued decision in principle), the borrower is empowered with significantly greater control during the purchase process. This not only increases the likelihood of deals being completed but enables borrowers to negotiate price discounts on the property in the same way a cash buyer would (typically leading to a 4-5% reduction in purchase price).

Founded in 2017 by seasoned financial services executives Stuart Cheetham (Lloyds, Prudential) and Richard Fitch (Halifax, Credit Agricole), M∙QUBE mortgages will be available exclusively through intermediaries (mortgage brokers), enhancing its distribution capability whilst ensuring customer outcomes are best served during what is typically their largest and most emotive financial decision.

For mortgage intermediaries, M∙QUBE enhance certainty of outcome, providing decisions in almost real-time and requiring only a fraction of the administrative tasks typically involved (M∙QUBE supports paperless applications).

As well as supporting excellent customer rates, M∙QUBE’s unique, low cost operating model enhances returns for buy-side investors, enabling them to deploy capital into the market faster, with a simultaneous reduction in asset risk driven by the robustness of the data-led underwriting process.

Stuart Cheetham, M∙QUBE co-founder and CEO said “The UK mortgage market is one of the very few sectors in which consumers are yet to seriously benefit from advances in technology. We have built a technology platform that will lead to better outcomes across the eco-system, in particular for borrowers and mortgage intermediaries. M∙QUBE has the power to transform this largely un-innovated market for the benefit of all key stakeholders and improve returns for banks, building societies and institutional investors in the process.

Our mission is to help more people get the mortgage that best meets their needs, whether they intend to buy a home or are landlords investing in their family’s future. The current solutions are antiquated and simply do not offer the flexibility that consumers have become accustomed to in almost every other business sector. For example, in the UK there are huge swathes of the population which can afford their rent but are unable to get a loan to buy a property. This is just one example of the problems that we aim to solve.”

Miles Kirby, Managing Director, AV8 Ventures said: “We are delighted to be

supporting M∙QUBE. It is an outstanding company and will be able to help many people that are currently struggling to finance the purchase of a property. The technology that M∙QUBE has built is truly unique and will transform the mortgage market and the way mortgages are done, pushing the industry into the 21st century. We look forward to continuing to support M∙QUBE as they launch into the mortgage lending marketplace.”

Max Bautin, Managing Partner, IQ Capital said: “The mortgage industry is one of the few industries that has remained largely untouched by innovation and none of the recent entrants to the market in the UK have introduced disruptive products or successfully scaled to a noticeable size. M∙QUBE is applying very specific deep technologies to a commercial problem, and is successfully bringing both together. We believe it has the potential for global scale.”

Working alongside the company’s co-founders is a senior management team with over 100- years of financial services experience, including executives from Visa, Experian, Gain Capital and a co-founder of Starling Bank.

M∙QUBE were solely advised by IMAS Corporate Finance during the fundraise.

M∙QUBE launches to transform the £270bn UK mortgage market

November 07, 2019